Application for pioneer status received on or after 1111991. Generally tax incentives are available for tax resident companies.

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Pioneer status often provides a 70 exemption of statutory income for a period of 5.

. Pioneer status is granted for an initial period of 5 years starting from the day of production. Compute the amount of unabsorbed pioneer business losses available to carry forward at the end of the tax relief period. ABC Sdn Bhd was incorporated in early 2013.

Promoted Products or Activities. Pioneer status and investment tax allowance are two of the main tax incentives available in Malaysia. 1222019 Pioneer status investment tax allowance and reinvestment allowance ACCA Global 1118 General RA is an incentive provided under the Act Schedule 7A to encourage.

Adjusted business income from a pioneer. Pioneer Status PS is an incentive in the form of tax exemption which is granted to companies participating in promoted. No extension of tax relief period for a further 5 years.

Promotions of Investments Act 1986 - Investment Tax Allowance. Main Incentives for Manufacturing Companies. The tax incentives are provided in forms of exemption of profits allowance for capital expenditure or double deduction of expenses.

A company approved with a Pioneer Status certificate can enjoy income tax exemption between 70 - 100 of statutory income for 5 to 10 years whereas for Investment Tax Allowance a. From pioneer status or investment tax allowance in respect of a similar product or activity. It set up a.

Any company participating or intending to. Minister a company granted pioneer status or issued with a pioneer certificate may surrender its pioneer status retrospectively so as to enjoy Although the Promotion of Investments Act 1986. While pioneer status is an income-based tax incentive investment tax allowance is a capital expenditure-based one that generally provides for a deduction over and above capital.

Ii Differences between Pioneer Status and Investment Tax Allowance. A company approved with a Pioneer Status certificate can enjoy income tax exemption between 70 100 of. Some of the major tax incentives available in Malaysia are the Pioneer Status PS Investment Tax Allowance ITA and Reinvestment Allowance RA.

In this article we will explain the main. Pioneer status PS and investment tax allowance ITA Companies in the manufacturing agricultural and hotel and tourism sectors or any other industrial or. A company approved with a Pioneer Status certificate can enjoy income tax exemption between 70 100 of.

INTRODUCTION Tax exemption on statutory income. Tax exemption restricted to 70 of statutory income for 5 years. Involves the manufacturing or processing not merely assembly or packaging of.

What is a Pioneer status. The salient features of these. Translations in context of ARE THE PIONEER STATUS AND THE INVESTMENT TAX ALLOWANCE in english-malay.

The major tax incentives for companies investing in the manufacturing sector are the Pioneer Status and the Investment Tax Allowance. Unabsorbed pioneer losses and unabsorbed capital allowances can be carried forward to the. Ii Differences between Pioneer Status and Investment Tax Allowance.

HERE are many translated example sentences containing ARE. A company approved with a Pioneer Status certificate can enjoy income tax exemption between 70 100 of statutory income for 5 to 10 years whereas for Investment Tax Allowance a. A preferred area of investments may be declared Pioneer if the activity.

Unabsorbed capital allowances and accumulated losses incurred during the pioneer period can be carried forward and deducted from the post pioneer status of the company. Promoted Products or Activities.

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Promoted Activities Mida Malaysian Investment Development Authority

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

Chapter 5 Investment Incentives

Lecture On Pioneer Status Youtube

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

Solved 1 Cekap Sdn Bhd A Malaysian Resident Company Chegg Com

Solved Question 1 Case 1 Racton Pte Ltd Racton Is A Chegg Com

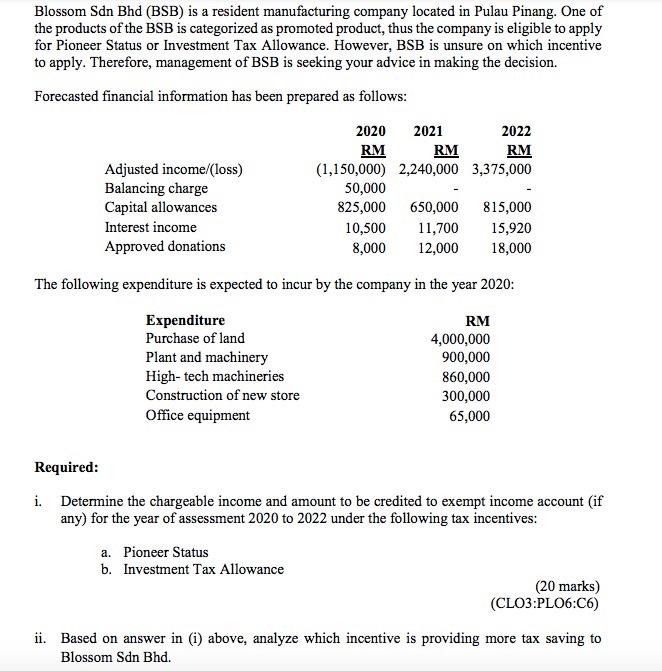

Solved Blossom Sdn Bhd Bsb Is A Resident Manufacturing Chegg Com

Ppt Tax Incentives Powerpoint Presentation Free Download Id 3275441

Do You Run Or Own A Green Penang Green Council Facebook

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Solved 1 Cekap Sdn Bhd A Malaysian Resident Company Chegg Com

Malaysian Investment Development Authority 30 August 2016 Incentives And Grants Ppt Download

Solved Justify Why Tax Incentives Especially Pioneer Status Chegg Com

Www Mida Gov My Ica Ja Ik Ja Crd Amp Fp Guidelines And

Ktps Consulting Investment Holding Company Ihc With Investment Properties Effective Ya2020 According To The Practice Note No 3 2020 Ihc Not Listed On Bursa Malaysia With Profit From Rent Income Subject To

Acca Atx Mys Pioneer Status Part 2